As part of an end-of-year pandemic relief package, Congress has passed several changes to the Paycheck Protection Program (PPP) and created a “Second Draw” PPP for small businesses who have exhausted their initial loan. Other changes impact eligibility for initial PPP loans, the loan forgiveness process, and the tax treatment of PPP loans.

At this time, the SBA and Treasury have not yet released specific guidelines for these programs. As information continues to be released, the NIACC Pappajohn Center & SBDC will keep you updated.

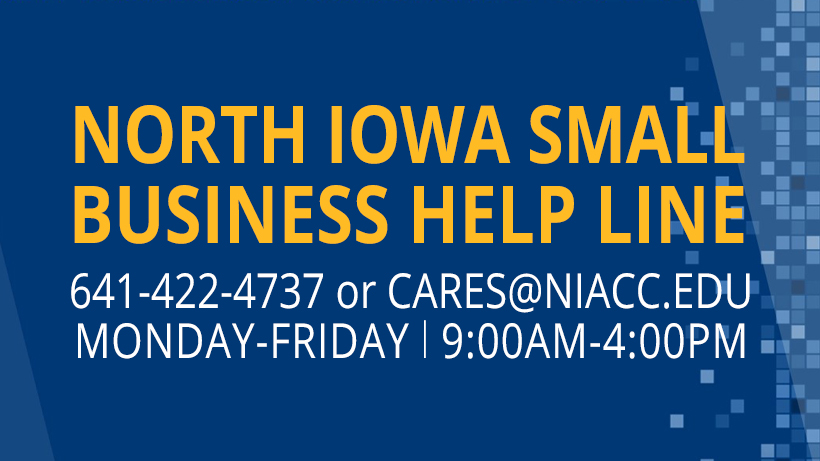

If you have questions about how to prepare to apply for a Paycheck Protection Program loan, North Iowa small business owners can contact the North Iowa Small Business Help Line (641) 422- 4737 Monday through Friday, 9:00 AM to 4:00 PM, or email cares@niacc.edu.

Congress has also made changes to other programs – including Economic Injury Disaster Loans (EIDL Program), the Employee Retention Tax Credit, a Venue Grant program, and SBA loan programs –that will benefit small businesses. The US Chamber of Commerce has created a useful FAQ Guide to Small Business COVID-19 Emergency Loans. (link opens in new tab)

We also recommend business owners review the following guides and summaries.

- COVID-19 Emergency Relief Package Detailed Summary of New Agreement (PDF opens in new tab)

- Small Business Title COVID Package Section-by-Section 12.21.20 v2 (PDF opens in new tab)

- Ways and Means Provisions in the 2020 Year-End Legislation (PDF opens in new tab)

The NIACC Pappajohn Center & SBDC offers free, confidential services.

If you are a client and need to speak with someone, please contact us at 641.422.4111 or pappajohn@niacc.edu

If you are not a client and need to speak with a business counselor, please complete this request for business counseling.